In the world of forex trading, understanding the concept of spread is crucial for effective trading strategies. One of the most important aspects that traders need to familiarize themselves with is the Exness live spread. exness live spread Exness Kuwait provides traders access to competitive spreads that can influence the overall trading experience.

The spread is defined as the difference between the bid and the ask prices of a currency pair. It is essentially the cost of trading, as this is the amount brokers take as a commission for facilitating trades. Different brokers offer various types of spreads, including fixed, variable, and live spreads, which change depending on market conditions. Exness, a reputable forex trading platform, offers live spreads that fluctuate based on real-time market data.

Why is the Exness live spread important? For traders, particularly those who implement short-term trading strategies such as scalping or day trading, the spread can significantly influence profitability. A lower spread means that traders can enter and exit positions with reduced costs, enhancing their potential gains. Moreover, understanding how live spreads work can help traders make more informed decisions regarding their entry and exit points.

One of the advantages of Exness live spreads is that they adapt to the current market volatility. This feature ensures that traders receive the best possible prices during market fluctuations. For instance, during major economic news releases, spreads might widen due to increased volatility. However, for most of the time, Exness offers tight spreads, making it an attractive option for many traders.

To illustrate, let’s consider a situation where a trader is looking to buy the EUR/USD currency pair. If the current ask price is 1.1200 and the bid price is 1.1198, the spread would be 2 pips. This means that the trader would need the price to move 2 pips in their favor to break even on this trade. In contrast, if a different broker were to have a spread of 5 pips, the trader would need a greater price movement, highlighting the importance of choosing a broker with competitive live spreads like Exness.

Furthermore, traders should be mindful of the times they choose to trade, as spreads can widen during periods of low market liquidity, such as during off-hours or over weekends. This is particularly important for traders who employ strategies that are sensitive to spread, such as scalping. Being aware of when the live spread might widen can help traders optimize their strategies and potentially enhance profitability.

Another critical factor to consider with Exness live spreads is the impact of economic indicators on the markets. Major announcements, such as central bank interest rate decisions or employment reports, can cause increased volatility, thereby affecting the spread. As such, staying informed about upcoming economic events can help traders be prepared for potential changes in spread conditions.

Exness not only provides live spreads but also offers a range of trading instruments, including forex pairs, commodities, and cryptocurrencies, allowing traders to take advantage of diverse market opportunities. Each instrument may have different spread characteristics, and understanding these can help traders develop more tailored strategies based on their trading preferences and objectives.

Another key consideration when dealing with Exness live spreads is the trading platform itself. Exness offers various platforms such as MetaTrader 4 and MetaTrader 5, which allow traders to monitor live spreads in real time. The Metatrader platform is equipped with tools and indicators that provide traders with insights into market conditions and can aid in making timely trading decisions.

To maximize trading success with Exness live spreads, it’s essential to employ risk management strategies. Setting stop-loss and take-profit levels can help manage exposure to adverse price movements. This is particularly important in the fast-paced forex environment, where market conditions can change rapidly. Additionally, understanding one’s own risk tolerance can assist traders in determining the appropriate position sizes based on the live spread.

One effective strategy when dealing with live spreads is to analyze and keep track of the spread’s behavior over time. Traders can use historical data to identify patterns, which can provide insights into average spreads during different trading sessions or events. This analysis can be especially beneficial for developing a trading plan tailored to one’s specific trading style and preferences.

Educating oneself about the intricacies of spreads and their potential impact on trading outcomes is crucial for becoming a successful trader. Whether one is a beginner or an experienced forex trader, consistently evaluating live spreads, staying updated on market conditions, and continually refining strategies can contribute to a more profitable trading experience.

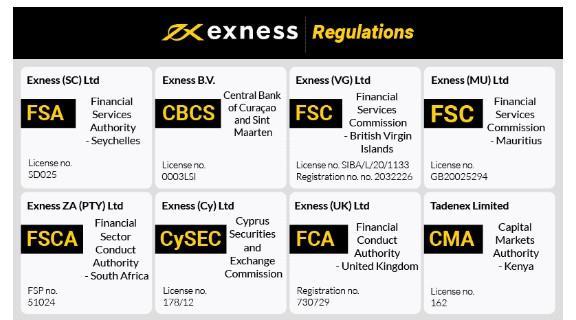

In conclusion, understanding the concept of Exness live spread is fundamental for anyone looking to make the most out of their forex trading experience. With its competitive live spreads, comprehensive trading tools, and educational resources, Exness offers a robust platform for traders to navigate the complexities of the forex market effectively. By staying informed and employing prudent trading strategies, traders can leverage live spreads to enhance their overall trading performance and achieve their financial goals.